Unraveling the Mysteries of Behavioral Finance: A Personal Journey

As someone deeply entrenched in the world of artificial intelligence, cloud solutions, and myriad technological innovations, my venture into understanding the complex realm of Behavioral Finance might seem a bit off the beaten path. However, the allure of unraveling the psychological undertones that influence financial markets has piqued my curiosity, mirroring my fascination with Bayesian Networks and their capacity to bridge uncertainty in AI.

What is Behavioral Finance?

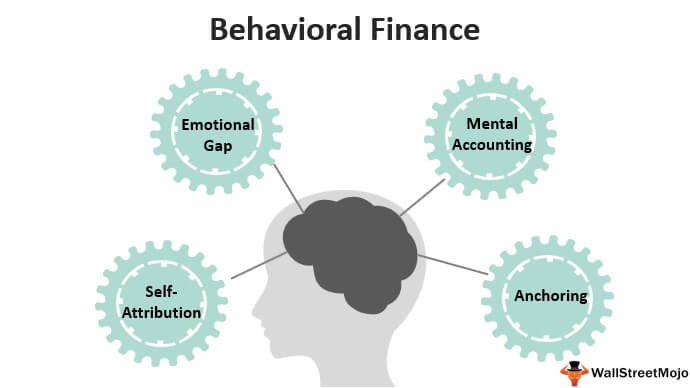

Behavioral Finance stands at the intriguing crossroads of psychology and economics, challenging the traditional notion that individuals always act rationally when making financial decisions. It delves deep into why investors often make seemingly irrational choices, influenced by their psychological biases and emotions, which can lead to predictable outcomes in financial markets.

< >

>

Personal Encounters with Cognitive Biases and Heuristics

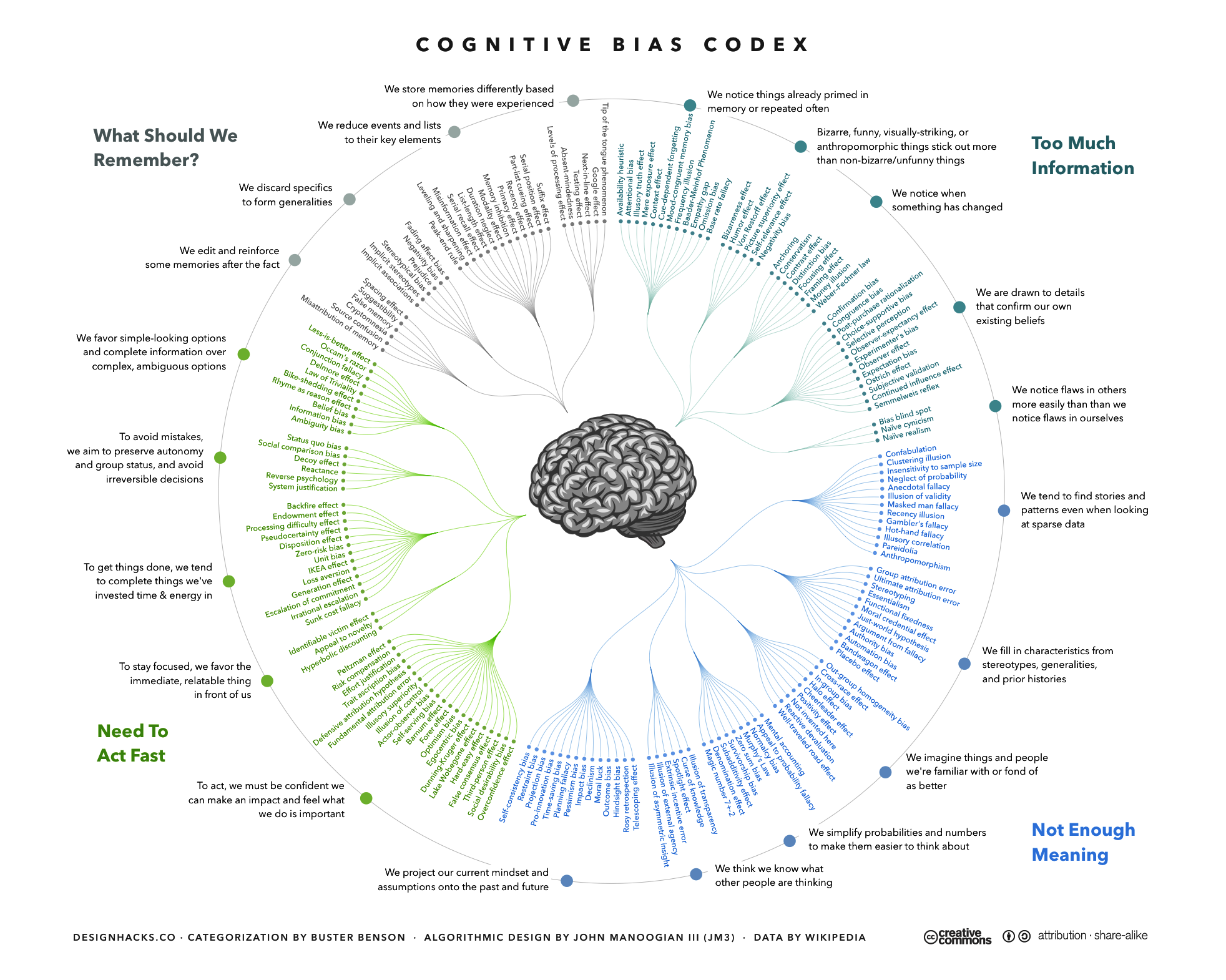

The journey into Behavioral Finance began with my encounter with Cognitive Biases and Heuristics. As someone who’s ventured into various fields, from AI to photography and even to the disciplined practices of piano music, I’ve observed firsthand how biases and heuristics shape our decisions. These psychological shortcuts allow us to make quick decisions but can often lead us astray, especially in the financial domain.

- Confirmation Bias: In my past projects, particularly those involving machine learning models, confirmation bias often crept up, leading us to favor information that confirmed our pre-existing beliefs or hypotheses, disregarding evidence to the contrary.

- Overconfidence: Running a consulting firm has taught me that overconfidence can sometimes lead to overlooking potential risks, similar to how investors might overestimate their knowledge or the predictability of the market.

< >

>

Prospect Theory: An Eye-Opener

Perhaps one of the most enlightening aspects of Behavioral Finance has been learning about Prospect Theory. This theory suggests that people value gains and losses differently, leading to decisions based on perceived gains rather than actual outcomes. For example, the pain of losing $100 is more intense than the joy of gaining the same amount. This resonated with me deeply, reflecting on various decisions made not just in finance but in life’s broader spectrum.

Application of Prospect Theory

In my own experiences, particularly with investments and managing the risks with my ventures, I’ve seen the stark relevance of Prospect Theory. It’s fascinating how this theory applies universally, affecting decision-making beyond the finance world, influencing how we manage risk, rewards, and assess probabilities in our daily lives and businesses.

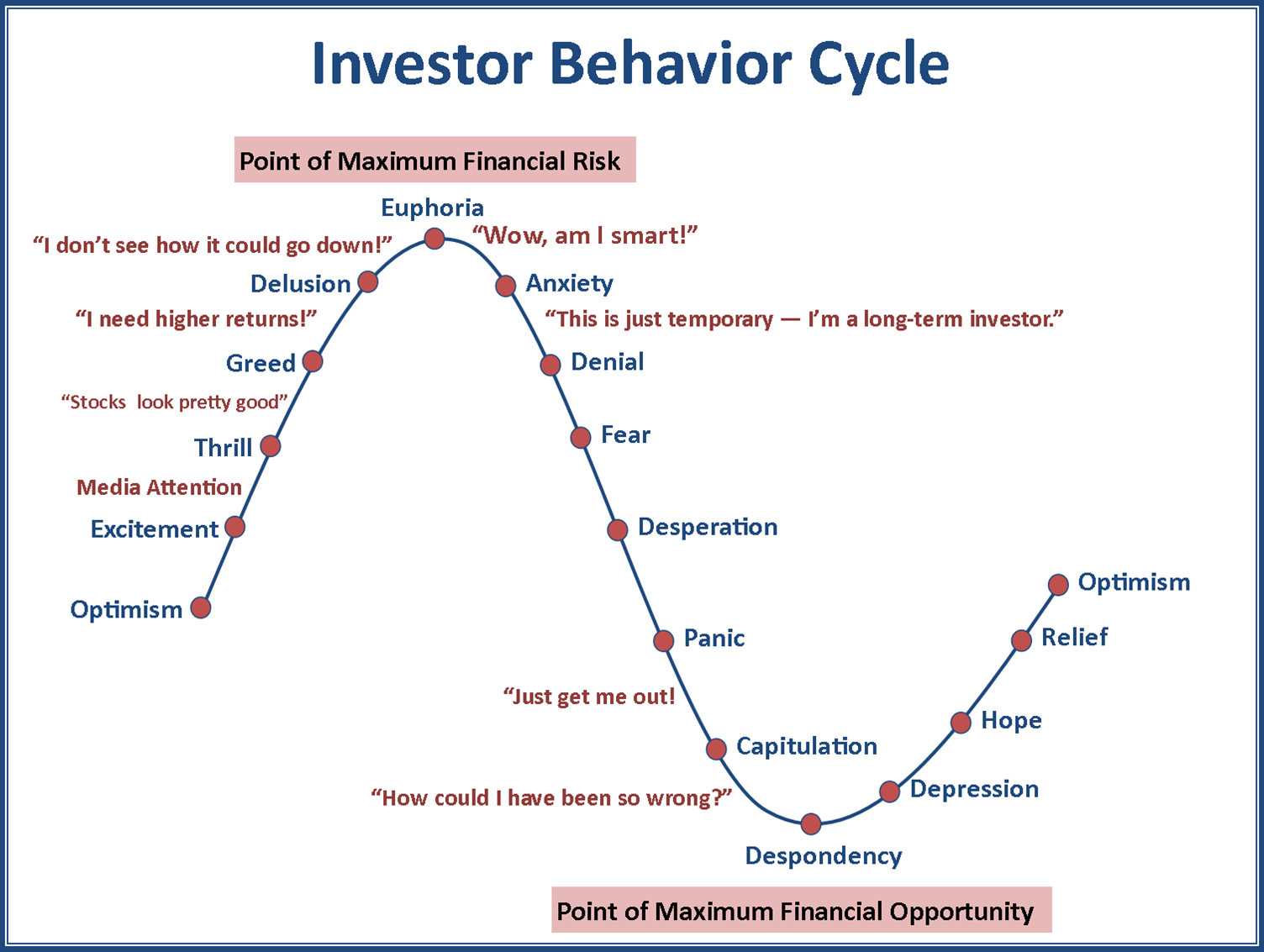

Behavioral Finance in Action: A Practical Analysis

Curiosity led me to delve deeper, applying the concepts of Behavioral Finance to analyze market trends and investment patterns. For instance, examining the stock market’s reaction to news reveals how investor sentiment, driven by fear or greed, can dramatically swing the market, often independently of the fundamental value of stocks.

| Date | Event | Market Reaction | Possible Behavioral Finance Explanation |

|---|---|---|---|

| 2024-02-27 | Release of Economic Indicators | Market Dips | Investors’ overreaction to news, driven by availability bias. |

| 2024-02-29 | Announcement of Technological Breakthrough | Market Surges | Overconfidence and herd behavior leading to speculative bubble. |

Such analysis offers a fascinating glimpse into the irrational yet predictable patterns of market behavior, shedding light on the powerful impact of human psychology on financial decisions and market movements.

< >

>

Concluding Thoughts

Embarking on this journey into Behavioral Finance has been an enlightening experience, offering profound insights into the psychological factors driving our financial decisions. It emphasizes the necessity to remain aware of our biases and the psychological dynamics at play, encouraging a more nuanced approach to investment and financial planning. As someone passionate about exploring the landscapes of AI, technology, and beyond, the exploration into Behavioral Finance has been a noteworthy chapter in my lifelong quest for knowledge and understanding.

For anyone curious about the financial world or striving to make more informed financial decisions, diving into the concepts of Behavioral Finance can provide valuable perspectives, enabling a deeper understanding of the often irrational forces that shape our economic lives.