Exploring the Ripple Effects: The $30 Billion Interchange Settlement and its Aftermath

In an unprecedented move, Visa and Mastercard have settled for a colossal $30 billion in an interchange fee agreement. Announced this past Tuesday, the agreement comes with significant implications for merchants, consumers, and the broader financial ecosystem. While the surface impact on consumers appears to be minimal, the undercurrents of this settlement are poised to create waves across the industry.

Understanding the Settlement

The agreement, resulting from lengthy legal battles, allows for a dual-routing system that could potentially lower transaction costs for merchants. The core of this settlement lies in the interchange fees—fees charged for each transaction made with a credit or debit card. These fees have long been a point of contention, seen as disproportionately high and benefiting card networks at the expense of merchants.

The Immediate Consumer Impact: A Surface-Level View

Initial analysis suggests that the direct impact on consumers may be negligible. The simple math behind the swipe fee agreement indicates that, at least in the immediate term, consumers might not see a noticeable difference when swiping their cards at the register. This finding might come as a relief to those apprehensive about potential fee hikes being passed down to the consumer level.

Potential Long-Term Implications for Consumers

However, to assume the implications end here would be shortsighted. The settlement opens the door for merchants to explore alternate routing options for card transactions, potentially lowering their operational costs. Over time, this could translate into pricing strategies that either benefit consumers or offset other rising business expenses. The question remains: Will merchants pass these savings onto consumers, or will they be absorbed into profit margins?

The Wider Impact on the Financial Ecosystem

The ripple effects of this settlement extend far beyond consumer wallets. By implementing a dual-routing system, we’re likely to see a shift in the competitive landscape among payment processors. Smaller processors could gain a foothold in a market traditionally dominated by a few key players, fostering innovation and potentially improving the overall efficiency of financial transactions.

Moreover, this settlement might catalyze further regulatory scrutiny into interchange fees and the practices of card networks. As an advocate for technology’s role in enhancing operational efficiency, I foresee this landscape evolving towards more transparent, cost-effective solutions that benefit all stakeholders in the financial ecosystem.

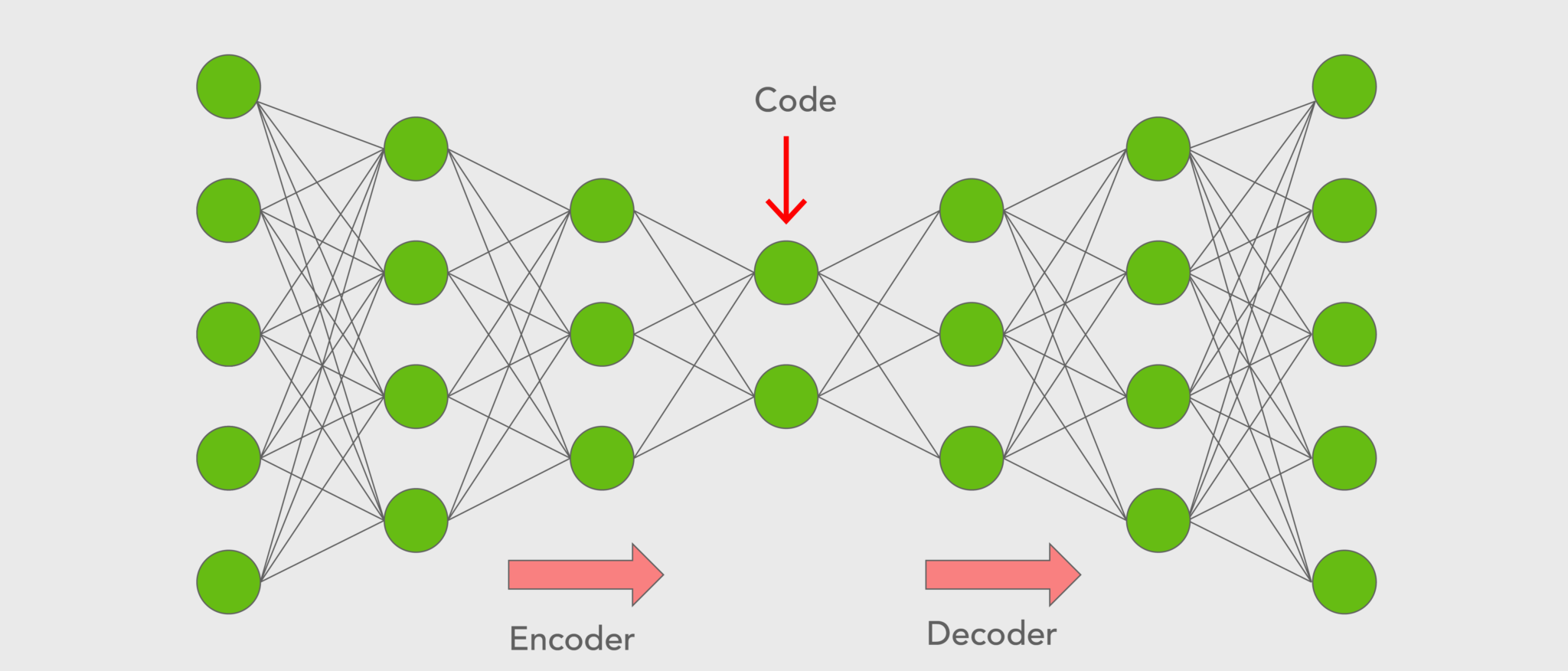

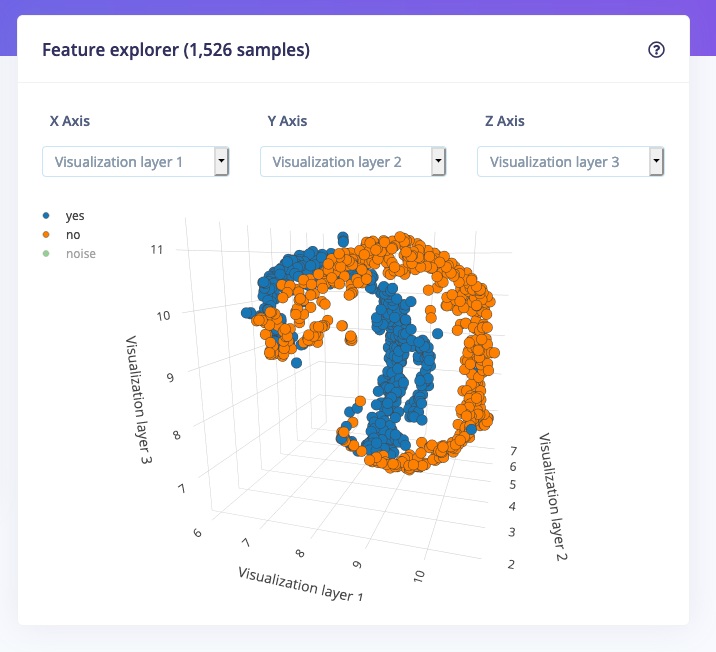

Connecting the Dots with AI and Number Theory

In previous discussions on my blog, I delved into the profound impact of AI on industries and how advancements in number theory have been instrumental in cryptography, laying the groundwork for secure digital transactions. This interchange settlement highlights the ever-present need for robust, secure, and efficient transaction mechanisms—an area where AI can play a pivotal role in detecting fraud and optimizing payment routes. The mathematical principles underlying number theory continue to be foundational in developing algorithms that safeguard our financial transactions in this rapidly changing landscape.

Conclusion: Navigating Uncharted Waters

As we unpack the $30 billion interchange settlement, it’s clear that its implications are multifaceted, extending across the spectrum of stakeholders in the financial services industry. While consumers may not feel an immediate pinch, the deal heralds significant changes in the way merchants handle card transactions and the broader dynamics of the financial ecosystem. Embracing technology and leveraging the principles of mathematics and AI will be crucial in navigating these changes, ensuring security and efficiency remain at the forefront.

As we continue to monitor the effects of this monumental settlement, let us remain optimistic about the future of financial transactions, underpinned by the relentless pursuit of innovation and fairness.

Focus Keyphrase: $30 billion interchange settlement

>

> >

> >

>