Nasdaq Hits Record Close After Powell Reassures Investors, CPI in Focus

The Nasdaq Composite reached a record closing high on Tuesday, while the S&P 500 and Dow Jones Industrial Average also saw positive gains. This comes after Federal Reserve Chair Jerome Powell’s remarks reassured investors amid the anticipation of Wednesday’s key consumer inflation report.

Federal Reserve Chair’s Reassurances

U.S. producer prices saw a significant increase in April, surpassing expectations due to a sharp rise in the cost of services and goods. This led some traders to scale back on their bets of a potential interest rate cut in September. However, Powell pointed out that the producer price index report was somewhat mixed, as prior-period data was revised lower.

Powell also indicated that he does not foresee the central bank’s next interest rate move to be a hike, despite recent higher-than-expected inflation data. “The market is getting more comfortable with higher-for-longer rates. The real question has been lately if a hike is a possibility and Powell’s reiterating that it’s not on the table right now,” said Lindsey Bell, chief strategist at 248 Ventures in Charlotte, North Carolina. She also highlighted that stocks appeared to gain ground as Treasury yields declined.

“It seems that the bond market is digesting all this and the stock market is reacting to the bond market,” Bell said.

Investor Sentiment and Market Performance

Investors cautiously await Wednesday’s Consumer Price Index (CPI) figures to determine if the higher inflation indicators from the first quarter extended into April. Persistent inflation and a robust labor market have led financial markets and most economists to delay expectations for the initial Federal Reserve rate cut from March to September. Despite this, stocks have rallied so far this year, buoyed by better-than-expected first-quarter earnings and expectations of a rate cut.

On Tuesday, the Nasdaq Composite surged by 0.75%, closing at 16,511.18, easily surpassing its April 11 record close. The S&P 500 rose by 0.48% to 5,246.68, slightly below its March 28 record close. The Dow Jones Industrial Average also saw a rise of 0.32%, ending at 39,558.11.

| Index | Close Value | Change |

|---|---|---|

| Nasdaq Composite | 16,511.18 | +0.75% (+122.94 points) |

| S&P 500 | 5,246.68 | +0.48% (+25.26 points) |

| Dow Jones Industrial Average | 39,558.11 | +0.32% (+126.60 points) |

Sector Performance and Company Highlights

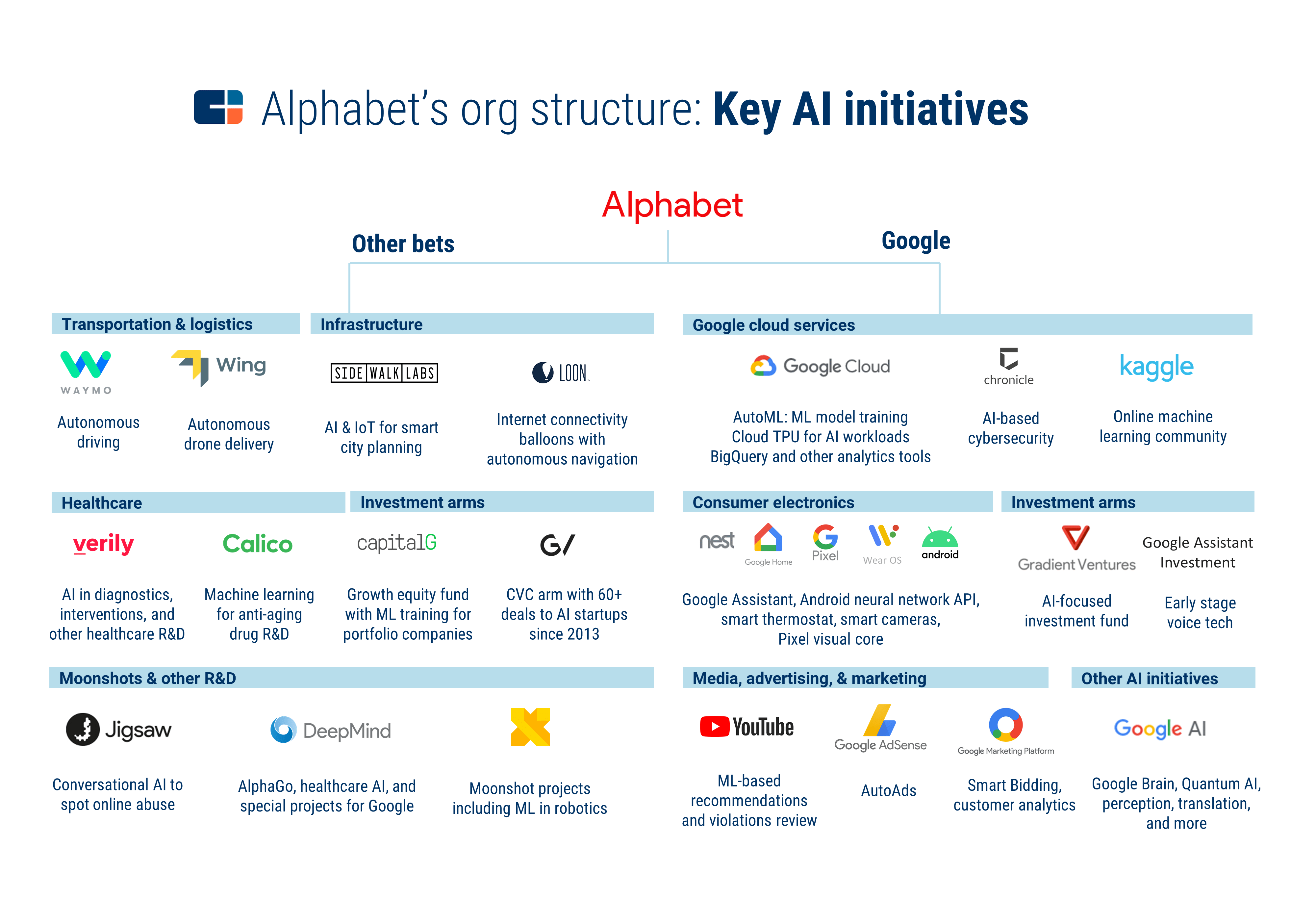

Among the S&P 500’s 11 major industry sectors, technology was the biggest gainer, adding 0.9%, while consumer staples declined by 0.2%. Shares of Alphabet closed up 0.7% after the company demonstrated how it is integrating artificial intelligence (AI) across its businesses, including enhancements to its Gemini chatbot and search engine improvements.

< >

>

Conversely, Home Depot’s shares closed down 0.1% after the retailer’s quarterly report showed a more significant than expected drop in same-store sales, suggesting that Americans are focusing more on small-scale home projects and spending less on big-ticket items.

In other news, shares of Chinese EV maker Li Auto saw a decline of over 2% following U.S. President Joe Biden’s announcement of steep tariff increases on various Chinese imports, including electric vehicles and computer chips. Meanwhile, Tesla gained over 3%.

<

>

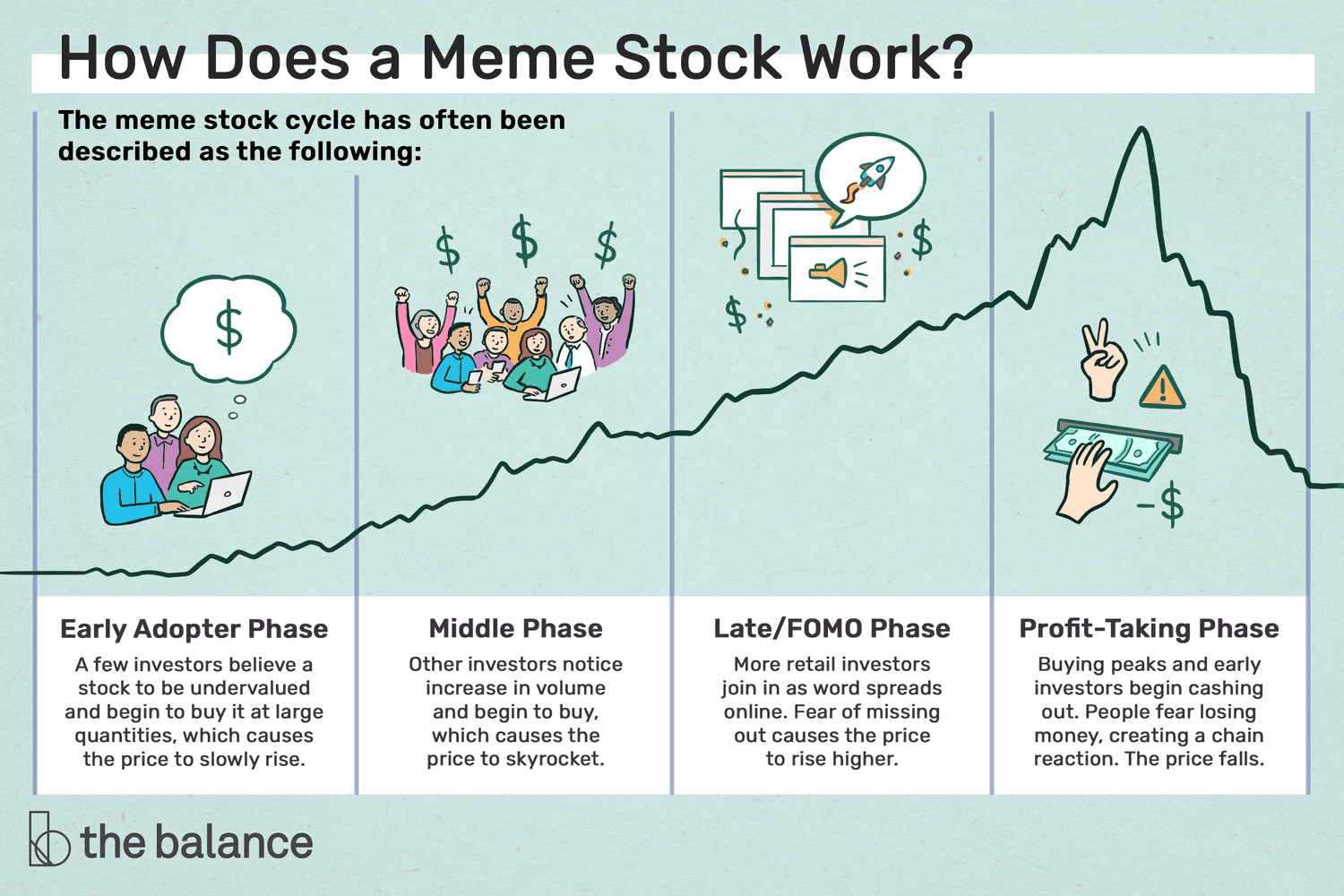

Meme Stocks and High-Profile Trades

The trading session also saw significant activity among well-known meme stocks. GameStop shares surged by 60% to $48.75 after the influential investor Roaring Kitty posted on X.com for the first time in three years. Other participants in the 2021 meme rally also saw impressive gains, with AMC Entertainment rising by almost 32% to $6.85 and Koss Corp ending up 40.7% at $6.15.

< >

>

Conclusion

The Nasdaq’s record closing underscores the resilience of the tech sector and investors’ growing comfort with the current economic environment, despite inflation concerns. As we await the crucial Consumer Price Index figures, it will be interesting to see how the stock market adjusts its expectations and strategies moving forward.

For a deeper dive into how sentiment analysis in AI can provide insights into these market trends and investor behaviors, feel free to explore my previous articles on DIY Self-Driving Car Kit and Revolutionizing Landscaping with AI.

Focus Keyphrase: Nasdaq record close after Powell reassurance

>

> >

> >

>