Analysis of the ARK 21Shares Bitcoin ETF

Welcome to my analysis of the ARK 21Shares Bitcoin ETF, a new financial instrument in the world of cryptocurrency investment. This Exchange-Traded Fund (ETF) represents a significant development in the digital asset market, offering investors a new way to engage with Bitcoin, the “de facto” cryptocurrency.

At the heart of the ARK 21Shares Bitcoin ETF’s strategy is its aim to closely track the performance of Bitcoin, thereby offering investors exposure to Bitcoin price movements without the complexities of direct cryptocurrency ownership. This ETF is designed to mirror the dynamics of Bitcoin, reflecting its value shifts and market trends, making it a unique instrument for investors looking to diversify their portfolio with digital assets.

In this article, I will delve into the fund’s structure, its investment strategy, and the potential risks and rewards associated with this innovative investment vehicle. The goal is to provide a detailed and insightful exploration, tailored for a financially literate audience, to understand better where the ARK 21Shares Bitcoin ETF stands in today’s investment landscape.

By the end of this analysis, readers will gain a deeper understanding of the ARK 21Shares Bitcoin ETF, its place in the market, and how it might align with various investment strategies in the ever-evolving world of digital assets.

Overview of the ARK 21Shares Bitcoin ETF

The ARK 21Shares Bitcoin ETF is a pivotal financial product, structured as an exchange-traded fund (ETF), offering investors a new avenue to engage with the cryptocurrency market. This ETF is listed on the Cboe BZX Exchange, a leading platform for ETF trading, ensuring accessibility and liquidity for investors.

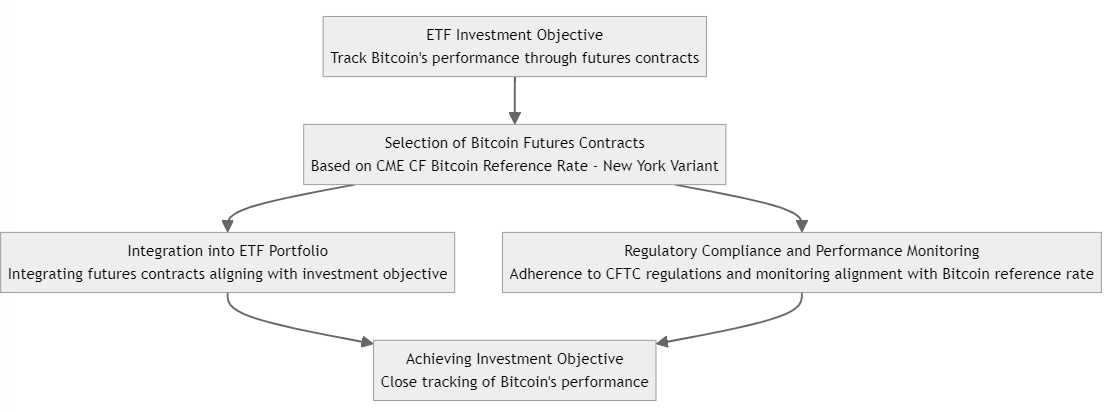

Central to this ETF’s strategy is its investment objective: to track the performance of Bitcoin as closely as possible. This is achieved by investing in standardized, cash-settled Bitcoin futures contracts traded on commodity exchanges registered with the Commodity Futures Trading Commission (CFTC). The aim is to provide investors with exposure to Bitcoin’s price movements in a regulated and transparent manner, without the need for direct investment in the cryptocurrency itself.

This ETF represents a significant step in bridging the gap between traditional investment mechanisms and the rapidly evolving world of digital currencies, offering a unique investment proposition to those looking to diversify their portfolios with cryptocurrency exposure.

Investment Objective and Strategy

The investment objective of the ARK 21Shares Bitcoin ETF is to track the performance of Bitcoin, employing a method that mirrors the CME CF Bitcoin Reference Rate – New York Variant. This reference rate is a standardized, widely-recognized benchmark for Bitcoin pricing, ensuring that the ETF’s performance aligns closely with the actual price movements of Bitcoin.

Table: Investment Strategy Breakdown

| Element | Description |

|---|---|

| Primary Objective | Track Bitcoin’s performance |

| Benchmark | CME CF Bitcoin Reference Rate – New York Variant |

| Investment Method | Utilization of cash-settled Bitcoin futures contracts |

| Exchange | Cboe BZX Exchange |

| Regulatory Compliance | Adherence to CFTC regulations |

The fund achieves this objective by primarily investing in Bitcoin futures contracts, which are financial derivatives allowing investors to speculate on the future price of Bitcoin without holding the actual cryptocurrency. This strategy provides a regulated, transparent, and efficient way to gain exposure to Bitcoin’s price movements, making it an attractive option for investors seeking cryptocurrency exposure within a traditional investment framework.

Role and Responsibilities of Key Players

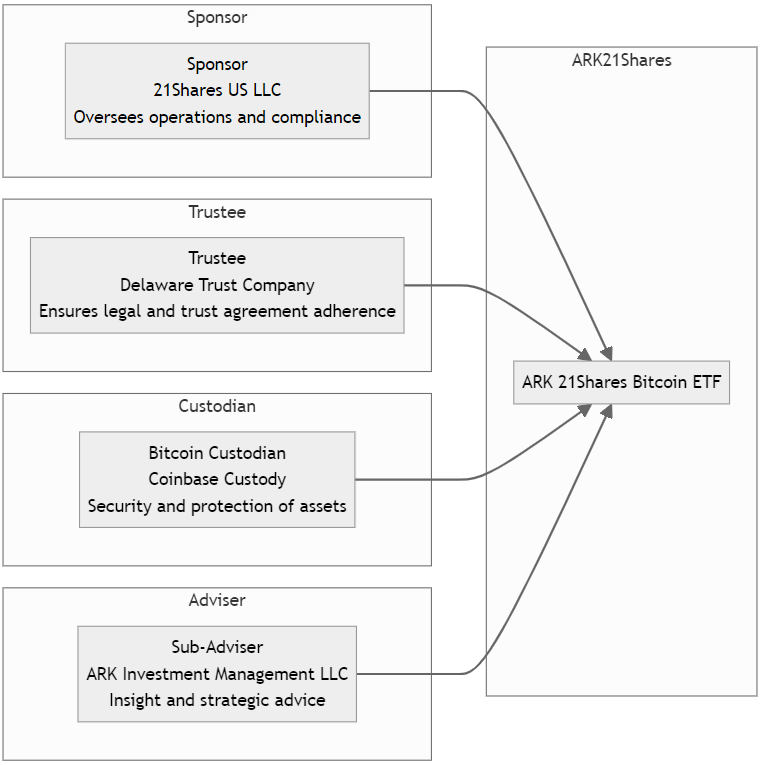

In the ARK 21Shares Bitcoin ETF, the key players each have distinct roles that ensure the smooth functioning and regulatory compliance of the fund:

- Sponsor – 21Shares US LLC: The Sponsor oversees the overall operation of the ETF, including but not limited to, ensuring regulatory compliance, overseeing the fund’s investment strategies, and managing administrative and marketing activities.

- Trustee – Delaware Trust Company: The Trustee is responsible for the general oversight of the ETF, ensuring that it operates in accordance with the trust agreement and applicable laws.

- Bitcoin Custodian – Coinbase Custody: Coinbase Custody, as the Bitcoin Custodian, handles the safekeeping of the Bitcoin assets involved in the fund. This includes ensuring the security and proper accounting of the Bitcoin holdings.

- Sub-Adviser – ARK Investment Management LLC: ARK Investment Management LLC acts as the Sub-Adviser, providing advice and recommendations on the fund’s investment strategies, particularly in relation to selecting and managing the Bitcoin futures contracts.

These roles are crucial in maintaining the integrity, security, and performance of the ETF, ensuring that it adheres to its investment objectives while complying with regulatory standards.

Performance Analysis

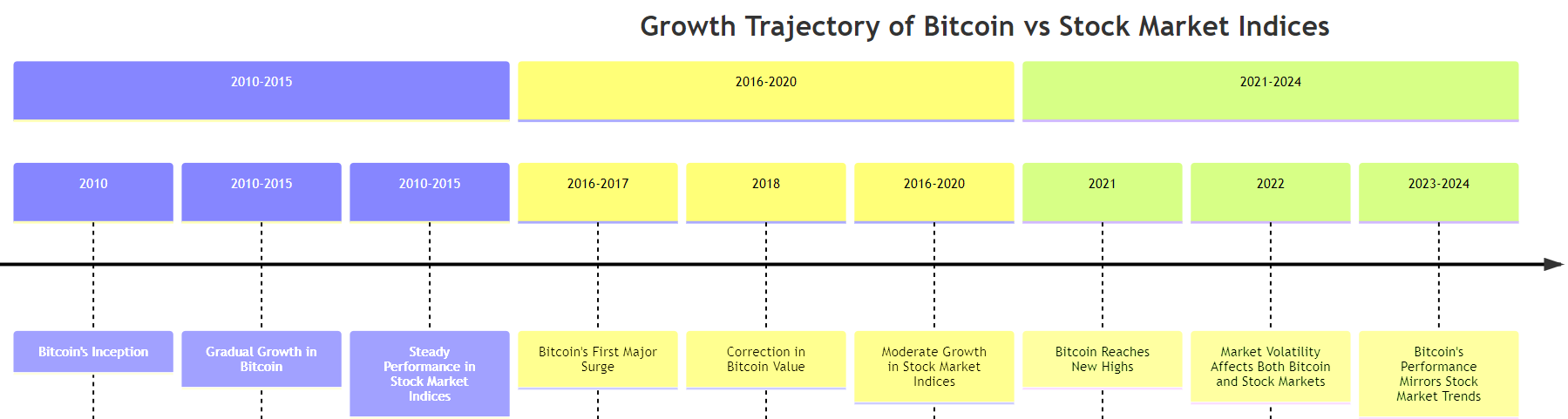

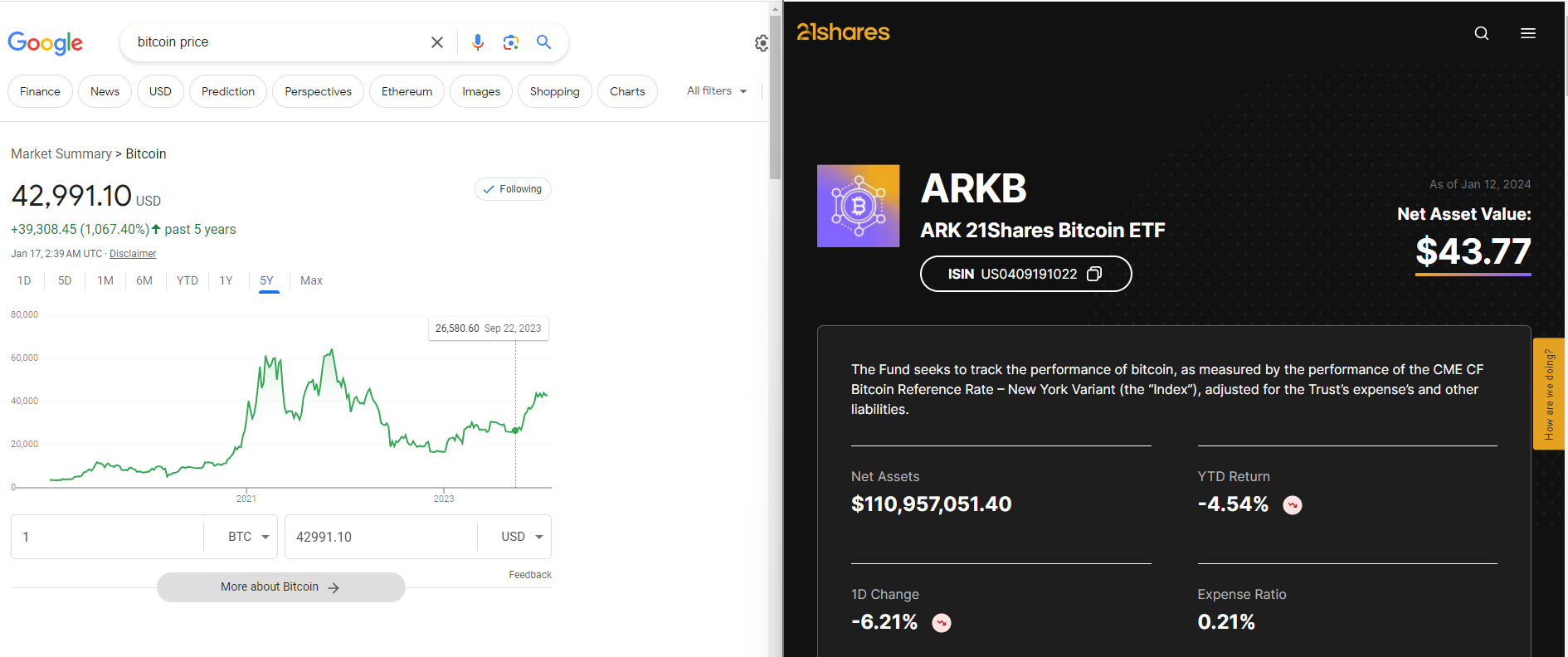

The ARK 21Shares Bitcoin ETF, known as ARKB, is designed to mirror the performance of Bitcoin. The fund’s historical performance, when available, will reflect the volatility and trends inherent to Bitcoin as illustrated in the provided historical price chart. Given Bitcoin’s dramatic price movements over the years, the ETF’s value would likewise exhibit significant fluctuations in a similar pattern.

Analyzing the recent snapshot of ARKB’s performance, which shows a Year-to-Date (YTD) return and an Expense Ratio, can offer insights into the fund’s current status compared to the broader historical context of Bitcoin’s price movement.

Comparison with Other Bitcoin Investment Vehicles

The ARK 21Shares Bitcoin ETF (ARKB) is distinct among Bitcoin investment vehicles due to its structure as an ETF. This allows for traditional investment with the added benefit of tracking Bitcoin’s performance. It stands out for its accessibility on major stock exchanges, regulatory compliance, and potentially lower investment thresholds.

Table: Comparison of Bitcoin Investment Vehicles

| Investment Vehicle | Accessibility | Regulatory Oversight | Potential Advantages |

|---|---|---|---|

| ARKB ETF | High (Stock Exchanges) | Strong (CFTC-regulated futures) | Ease of trade, familiar structure |

| Direct Bitcoin Ownership | Low (Cryptocurrency Exchanges) | Limited | Direct market exposure |

| Bitcoin Mutual Funds | Moderate | Varies | Professional management |

| Bitcoin Trusts | Moderate | Varies | Shares can be held in tax-advantaged accounts |

ARKB’s use of futures contracts to track Bitcoin’s price may offer more stability compared to direct ownership, and its stock exchange listing provides familiarity and ease of access for traditional investors. These factors, combined with professional management and regulatory oversight, position ARKB as a unique offering in the Bitcoin investment space.

Regulatory and Tax Implications

Investing in the ARK 21Shares Bitcoin ETF involves navigating a complex regulatory landscape as well as understanding the tax implications. The ETF is subject to regulations by entities such as the SEC and CFTC, given its structure and the use of futures contracts.

Table: Regulatory and Tax Overview

| Aspect | Details | Implications for Investors |

|---|---|---|

| Regulatory Body | SEC, CFTC | Compliance with federal securities and commodities laws |

| Tax Treatment | As per IRS guidelines for ETFs | Subject to capital gains tax; reporting requirements |

Investors should be aware that gains from the ETF could be taxed as capital gains, and they must report these in their tax filings accordingly. It is vital for investors to consult with a financial advisor or a tax professional to understand the specific implications for their individual circumstances.

Investor Suitability and Profile

The ARK 21Shares Bitcoin ETF is best suited for investors who are specifically looking to add digital assets to their portfolios as a means of diversification and potential growth. Ideal investors would be those with a strong understanding of the cryptocurrency market dynamics and a willingness to accept the possibility of substantial price swings, which are characteristic of Bitcoin investments.

Investor Profile:

- Risk Tolerance: Moderate to high, comfortable with significant price volatility.

- Investment Horizon: Long-term, able to withstand periods of market fluctuation without the necessity of liquidating positions.

- Market Knowledge: Informed about cryptocurrency and blockchain technology trends and their implications.

- Diversification Strategy: Seeks to include alternative investments as a hedge against traditional market movements.

- Tax Consideration: Aware of the tax consequences of ETF investments and prepared for potential tax liabilities associated with trading activities.

Fee Structure

To ensure potential investors are fully informed about the cost of investing in the ARK 21Shares Bitcoin ETF, it is essential to outline the fee structure comprehensively. Below is a table that details the various fees and expenses that an investor may incur.

Table: Fee Structure of ARK 21Shares Bitcoin ETF

| Fee Type | Description | Amount (%) |

|---|---|---|

| “Sponsor Fee: | Annual fee paid to the fund’s manager for operating the fund. | 0.21% |

| Administrative Fees | Fees related to the day-to-day administration of the fund. | To Be Determined |

| Custody Fees | Fees for the safekeeping of the fund’s assets. | To Be Determined |

| Distribution Fees | (If applicable) Fees for marketing and distributing the fund. | To Be Determined |

| Other Expenses | Includes various operational costs such as legal, compliance, and audit fees. | To Be Determined |

| Total Expense Ratio | The total percentage of the fund’s assets used for operational expenses. | To Be Determined |

The Trust will pay the unitary Sponsor Fee of 0.21% of the Trust’s bitcoin holdings. The Sponsor Fee is paid by the Trust to the Sponsor as compensation for services performed under the Trust Agreement. The Sponsor intends to waive the entire Sponsor Fee for (i) a six month period commencing on the day the Trust’s Shares are initially listed on the Exchange, or (ii) the first $1 billion of Trust assets, whichever comes first.

Except for during periods during which the Sponsor Fee is being waived, the Sponsor Fee will accrue daily and will be payable in bitcoin weekly in arrears. The Administrator will calculate the Sponsor Fee on a daily basis by applying a 0.21% annualized rate to the Trust’s total bitcoin holdings, and the amount of bitcoin payable in respect of each daily accrual shall be determined by reference to the Index. The Sponsor has agreed to pay all operating expenses (except for litigation expenses and other extraordinary expenses) out of the Sponsor Fee.

Market Outlook and Future Prospects

The Bitcoin market has been a subject of intense interest and scrutiny, with its value experiencing notable fluctuations over time. As the ARK 21Shares Bitcoin ETF (ARKB) closely tracks Bitcoin’s performance, it’s essential to consider the broader market outlook when evaluating the ETF’s future prospects.

The cryptocurrency market has seen increased institutional adoption, with major companies and financial institutions expressing interest in Bitcoin. This growing acceptance and recognition of Bitcoin as a legitimate asset class could potentially drive its adoption among traditional investors.

Moreover, the ongoing development of blockchain technology and the potential for wider adoption of cryptocurrencies in various sectors, including finance and technology, could further boost the prospects of Bitcoin and, by extension, ARKB.

It’s crucial to acknowledge the inherent volatility of Bitcoin and its susceptibility to regulatory changes and market sentiment. Investors should be prepared for price swings while maintaining a long-term perspective. Furthermore, staying informed about regulatory developments and market trends will be essential for making informed investment decisions.

Conclusion

In conclusion, the ARK 21Shares Bitcoin ETF offers investors an avenue to gain exposure to the cryptocurrency market through a traditional and regulated investment vehicle. While Bitcoin’s market is known for its volatility, ARKB provides a structured and accessible means of participating in this digital asset’s potential growth.

Investors should consider their risk tolerance, investment horizon, and financial goals when evaluating ARKB. It is advisable to consult with financial professionals and stay informed about regulatory changes and market dynamics.

The ETF’s ability to closely mirror Bitcoin’s performance, combined with the evolving landscape of digital assets, positions it as a unique investment option for those looking to diversify their portfolios. However, as with any investment, thorough research and careful consideration of one’s individual circumstances are essential.

Leave a Reply

Want to join the discussion?Feel free to contribute!