Exploring Financial Analysis Through a Tech Expert’s Lens

Deciphering the World of Financial Analysis: A Journey of Curiosity

As someone deeply entrenched in the fields of technology and innovation, my journey through various disciplines has always been driven by a relentless curiosity and a science-oriented approach. While my principal expertise lies within Artificial Intelligence and cloud solutions, I’ve recently found myself intrigued by the intricate world of financial analysis. This exploration stems from my broader interest in how data, algorithms, and predictive models — concepts I’m intimately familiar with — play pivotal roles in other realms, including finance.

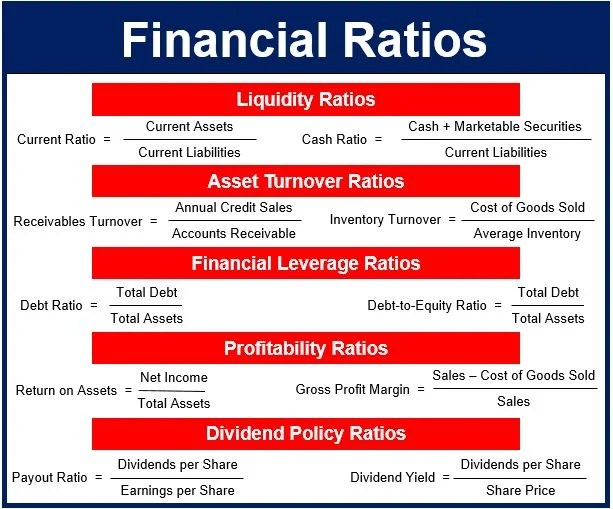

A Glimpse into Financial Ratios

One aspect of financial analysis that has caught my attention, in particular, is the use of financial ratios. These ratios, much like the algorithms in AI, serve as tools to decode complex information into understandable metrics, offering insights into a company’s performance, financial health, and overall efficiency. For someone accustomed to distilling vast datasets into actionable insights in AI, the parallel in financial analysis is both fascinating and instructive.

Understanding Liquidity Ratios

At the outset of my exploration, I delved into liquidity ratios, metrics that measure a company’s ability to meet its short-term obligations. Given the current economic climate, understanding a company’s liquidity seems more pertinent than ever. Two primary ratios in this category are:

- Current Ratio: Essentially, this measures a company’s ability to pay off its short-term liabilities with its short-term assets. The formula looks something like this: Current Assets / Current Liabilities.

- Quick Ratio: Also known as the acid-test ratio, it’s a gauge of a company’s immediate liquidity by comparing its most liquid assets, minus inventories, to its current liabilities. It can be represented as: (Current Assets – Inventories) / Current Liabilities.

These ratios, although simple at first glance, provide a deep insight into a company’s financial resilience, guiding decisions in investment and operational strategies.

The Significance of Profitability Ratios

Moving beyond liquidity, I was drawn to profitability ratios. As someone who’s navigated through the creation and growth of a consulting firm, understanding the dimensions of profitability seemed akin to evaluating the efficiency of an AI model. Key ratios such as Return on Assets (ROA) and Return on Equity (ROE) stand out as metrics that not only reflect a company’s financial health but also its operational effectiveness and managerial efficiency.

For instance, the ROE, calculated as Net Income / Shareholder’s Equity, reveals how well a company generates returns on the investments from its shareholders, mirroring, in a way, how well an AI model performs based on the data and resources fed into it.

Linking Financial Analysis to Technological Innovation

In my professional journey, from working on machine learning algorithms at Harvard to executing cloud solutions at Microsoft, the underlying theme has been leveraging technology to solve complex problems. Financial analysis, particularly through the lens of financial ratios, echoes this theme. It’s about sifting through data, discerning patterns, and making informed decisions.

Conclusion

Though my foray into financial analysis is guided more by curiosity than by necessity, the parallels to my work in AI and consulting are undeniable. As I uncover more about financial metrics and what they signify, the journey feels less like venturing into unfamiliar territory and more like extending my existing knowledge base into finance. Perhaps, this exploration will enrich my consulting practice further, enabling a more holistic view when advising companies on their technological and operational strategies.

For fellow technology enthusiasts venturing into finance or any other new field, remember: the essence of innovation lies in our ability to connect dots across disciplines. Whether it’s AI, cloud computing, or financial analysis, the underlying principles of curiosity, evidence-based evaluation, and strategic synthesis hold the key to unlocking new vistas of knowledge and opportunity.

For more insights into the intersection of technology and everyday life, explore similar topics at davidmaiolo.com.

Leave a Reply

Want to join the discussion?Feel free to contribute!